What Is a Funeral Plan?

Pay your family a lump sum payment for all funeral expenses.

A funeral plan is a simple way to pay for the funeral you desire in advance, fixed at today’s prices. Taking out a funeral plan will relieve your loved ones of the added expense and worry of preparing your funeral. This will leave your family with that all-important-time to grieve and will allow them to mourn healthily.

Preparing a funeral plan or applying for a prepaid funeral plan may not always be at the forefront of our minds. With constantly rising funeral costs, taking out funeral insurance at today’s cost is an important factor to consider. We compare the best value for money funeral plans by using the UK’s leading providers.

There are 2 ways you can buy a funeral plan;

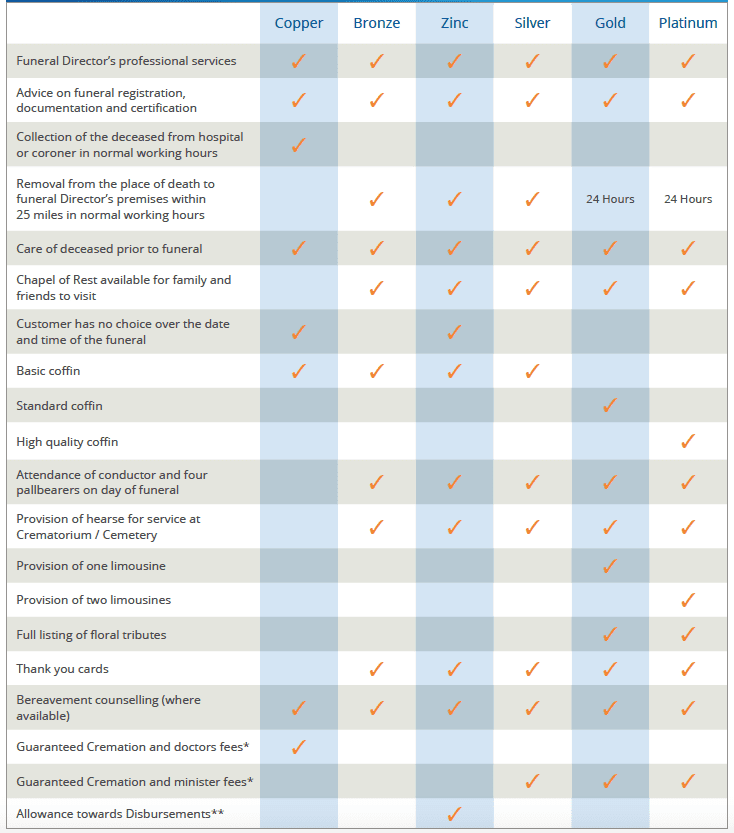

A funeral plan can be paid for in a cash lump sum or monthly instalments, ranging from one to tens years. One-off payments usually range between £1,693 (copper plan) and £4,199 (premium plan).

If you prefer to pay for your funeral in instalments, we offer affordable, flexible payment options to suit every budget. We will help you spread the cost of your funeral by applying a payment period that is ideal to you. Setting up a monthly direct debit will save you time and give you peace of mind in knowing you’re covered.

Our pay monthly funeral plans range from our simple single payment option, spreading the cost from 12, 24 or 60 months. If you prefer a longer funeral cover payment options, you can pay over 1, 2 or 5 years.

All details relating to payment plan options will be included within your bespoke prepaid funeral plan summary.

An over 50s funeral plan provides a cash lump sum to help pay towards your funeral after you pass away. It is similar to an over 50’s life insurance policy where you pay a fixed monthly premium payment. You are not required to undergo a medical exam or answer any medical questions. You are guaranteed acceptance for an over 50’s funeral plan if you are aged 50 or over.

It is important to note that it is possible to pay more into the policy than what is paid out. We understand the importance of protecting your investment and any gaining back benefits of any overpayment. If any money paid exceeds the amount of your funeral plan, this will automatically be put into a rebate feature. This simply means your estate will be eligible for a rebate due to the amount overpaid into the plan.

If your funeral service costs less than what is paid into your plan, you’ll also be eligible for a rebate. This can give you that little bit of extra-added financial security.

Our over 50s funeral plans start from £17.09 per calendar month. Depending on the type of plan and cover you choose, you can be covered within as little as 24hours. We can get you access to cheap funeral plans that are fixed at today’s prices.

Our range of cheap funeral plan packages means you can choose the arrangement you would prefer and can afford. Whether it is something simple or more elaborate, we have everything you desire for the perfect celebration of your life.

Disbursements (Payment of money from a fund)

*All of our Copper, Silver, Gold and Platinum plans are guaranteed for cremation funerals only.

**The Zinc plan provides a contribution towards disbursements.

**On plans where a contribution is made towards disbursements these include ministers fees, cremation fees. After the amount contributed, these costs may still require additional payment from estate / executors at the time of funeral. (See Terms & Conditions).

We are proud to share the news that we are currently working with the UKs leading funeral plan provider. Here are some of the top funeral plan deals readily available online. You can be covered by your chosen funeral plan within as little as 24hours.

*Collection from a Hospital or from a Coroner’s mortuary is included in the plan but removals from a home or a nursing home will incur an additional cost.

*Formal leaders within established religions

Chapel of Rest available for family and friends to visit

*The payment of money from a fund

**Formal leaders within established religions

*The payment of money from a fund

Guaranteed Cremation and minister fees*

Chapel of Rest available for family and friends to visit

*The payment of money from a fund

**Procession

Guaranteed Cremation and minister fees*

*The payment of money from a fund

**Procession

Guaranteed Cremation and minister fees*

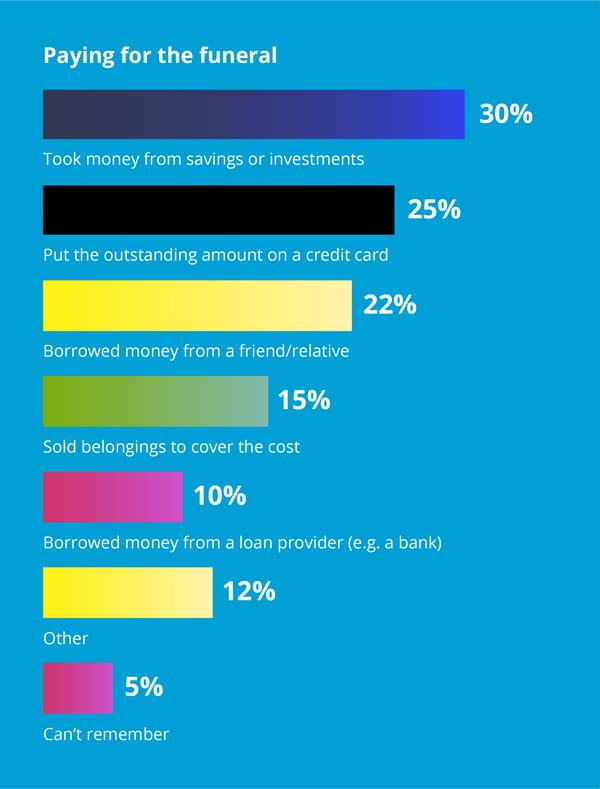

There are a variety of ways in which you can pay off your funeral cover. Here are some options that are available to enable you to choose the best policy for you or your family.

| Payment Options | How it Works |

|---|---|

| Single payments (Lump sum Payment) | The whole sum is paid within 30 days of application. |

| Monthly Instalments over 1-5 years: | You pay a monthly fee over a 12-60 month period (a deposit will be required). |

| Fixed monthly payments* | You pay a low monthly fixed payment until the age of 90 or until death – whichever comes first. |

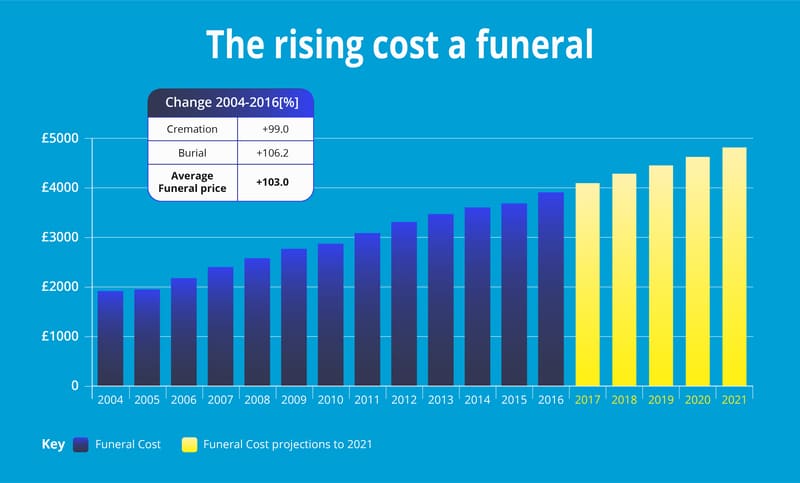

The cost of preparing a funeral is constantly on the rise. Even comparing recent figures during the current climate, there seems to be no evidence to show that this is declining. With the annual rate of inflation continually rising, these future arrangements can end up feeling unpromising to many families.

The Bank of England ‘Inflation Report August 2019’ states that the growth in the economy has slowed. It also details that the rate of inflation is currently at a 2% target.

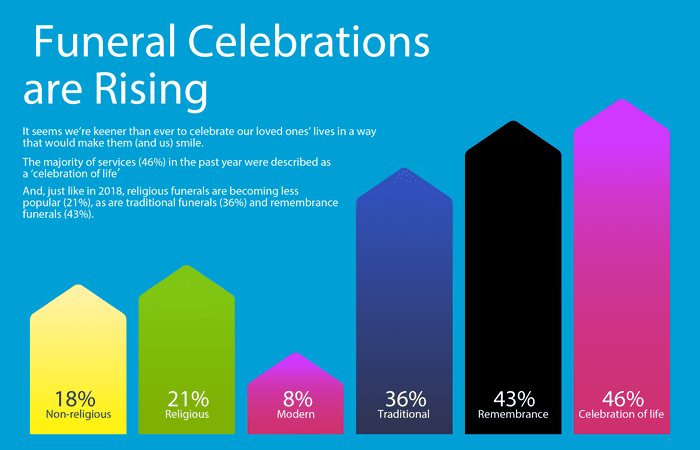

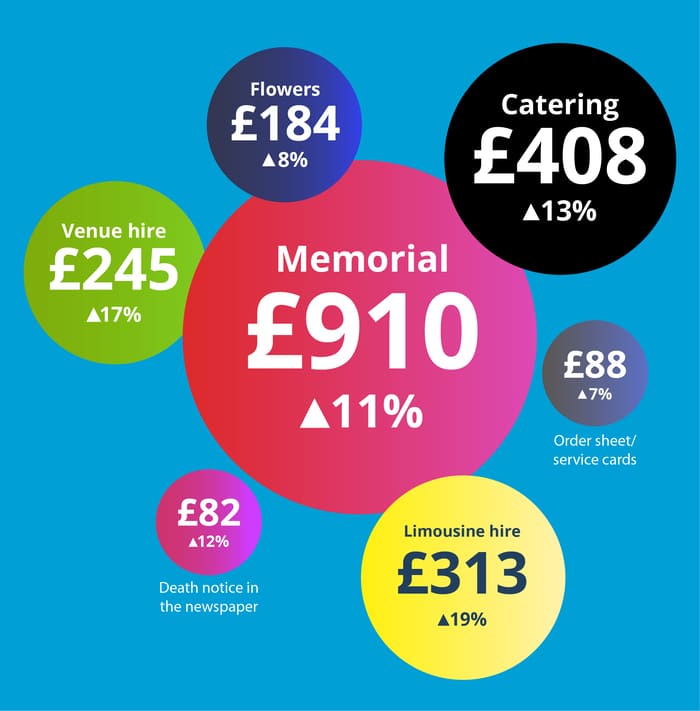

The ‘Sun Life - Cost of Dying Report 2017’ revealed that the average cost of a basic funeral was constantly rising. These statistics also demonstrated an increase in funeral prices for the 14th year running.In comparison with the previous report, this showed that funeral plan prices had gone up by a total of 4.7%. This indicates funeral plan prices ranged from £3,897 in 2016 until inflation highly impacted this to £4,078 in 2017.

Planning ahead and finding the right funeral plan in advance will ease any of your families funeral worries. They will have peace of mind in knowing that there is no added financial pressure during an already difficult time. Feel ‘funeral secure’ and take out a funeral plan or prepaid funeral plan with Quote Me Less today. It will leave you feeling confident that your funeral is already taken care of should anything unexpected happen.

Making the right decisions whilst planning a funeral is of upmost importance. At Quote Me Less, we work very closely with all of our insurance and are continuously improving our services. This ensures all of your essential funeral wishes are taken into consideration whilst we find you your perfect send-off.

When it comes to taking out funeral cover, you need to know your money is secure. Even though the Financial Conduct Authority (FCA) do not regulate funeral plans covered by insurance or trust arrangements. It does however stipulate rules for each types of investments and ensures any sums paid by the customer are safeguarded. All funds paid into trust will be readily available to pay for the funeral, when the time comes.

It is of paramount importance to us at Quote Me Less that your investment is protected. We ensure your money is safe and secure by complying with all current legislation.

‘The Financial Services and Markets Act 2000 (Regulated Activities) Order 2001 under Chapter XIV - Funeral Plan contracts, Section 60. (1b): - The provider undertakes to secure the sums paid by the customer under the contract will be held on trust. This is for the purpose of providing the funeral and that the following requirements are or will be met with respect to the trust.

(i) the trust must be established by a written instrument;

(ii) more than half of the trustees must be unconnected with the provider;

(iii) the trustees must appoint, or have appointed, an independent fund manager who is an authorised person. They must have permission to carry on an activity of the kind specified by article 37. This is a person who is unconnected with the provider, to manage the assets of the trust;

(iv) annual accounts must be prepared, and audited by a person who is eligible for appointment as a company auditor under section 25 of the Companies Act 1989. With respect to the assets and liabilities of the trust; and

(v) the assets and liabilities of the trust must, at least once every three years, be determined, calculated and verified by an actuary who is a Fellow of the Institute of Actuaries or of the Faculty of Actuaries.

Compare cheap funeral plan quotes with us today. All you need to do is click on the button below and let us do the hard work.

Quote Me Less believe in providing its customers with a more personal service. Our friendly and approachable team are on hand to ease any of your funeral financial worries. Unlike most price comparison sites, we compare and offer more bespoke funeral plans according to each customers wishes. We also work closely with some of the UK’s leading funeral plan and prepaid funeral plan providers. We aim to continuously bring customers the most affordable and competitive plans available in today's market.

All you need to do is complete our simple 2-minute online quote enquiry form. You can then sit back and relax whilst we start gathering the details and putting those all-important details together for you.

Compare cheap funeral plan quotes to get the best deals.

Stay up-to-date with our weekly online blogs on funeral guides, health and wellbeing, testimonials, expert opinions and more.

Do you have questions or concerns about taking out funeral cover? If so, it might be beneficial to look at our FAQ’s below which may be able to help you further.

If there are still sums that needs to be paid when you pass away. The funeral plan provider will ask your estate or your family to settle the balance before they instruct the funeral directors.

Taking out a funeral plan today safeguards you from the ever increasing costs of paying for a funeral. The price of your plan will be fixed at today’s prices and it also has the guarantee to never rise with inflation. Receive a funeral insurance quote from Quote Me Less to see how much you can save.

The Financial Conduct Authority (FCA) do not regulate funeral plans covered by trust arrangements or insurance. However, it does stipulate rules for each types of these investments and this ensures your funds are secure. All payments made under the contract will be held on trust and readily available to provide the funeral, when the time comes.

Depending on the type of funeral plan you chose to go with, your funeral plan can cover any of the following;

At Quote Me Less we guarantee that all customers will receive a response to their quote request within 24 hours after their online form submission.

If you have any additional comments, queries or requests you would like to add to your quote request form, please email these over to info@quotemeless.co.uk. Please ensure you include your name and contact details within this correspondence.

The key components to consider when planning a funeral are;

In the rare event that your funeral plan company becomes insolvent, you would be appointed another funeral directors straightaway. As funeral directors are not paid any funds until they have provided their service. You will always know your money is protected and your funeral is covered.

Here at Quote Me Less, we understand people’s circumstances and situations can change. That is why our prepaid funeral plans offer you a full refund if you cancel your plan within 30days of purchase. If you choose to cancel your plan after 30days, we will refund you the original amount paid, minus an administration fee of £295.00.

Our funeral plan providers accept anyone over the age of 18 years old. Funeral insurance relieves stress and financially worries when you pass away.

If you are concerned about meeting your monthly payments towards your prepaid funeral plan. Please reach out to your funeral plan provider directly, where they can offer you their advice and assistance.

Whether it is because your loved one has asked for your help, you are taking control of finances or acting on advice. It is paramount that you compare cheap funeral plans to find the best cover with the right level of service.

As long as the person is aged over 50, we guarantee they will be accepted for a prepaid funeral plan.

A cheap funeral plan is a easy way to pay for the funeral service you desire in advance, fixed at today’s prices.

It may not be easy to talk to your loved ones about your funeral but it is advisable to let someone know about your funeral plan. You can let them know -

This will relieve any stress to your family from making difficult decisions through and already upsetting and difficult time.

Pay your family a lump sum payment for all funeral expenses.

Read our top tips for when planning a funeral.

Registering a death is easier than it sounds.

Prepaid funeral plans can can be pid off in one lump-sum or spread over 10 years.

which plan is best for you.

Take a look to see why funeral plans save you money in a long run.

Follow our guide on funeral wishes