Over 50’s Life Insurance VS Funeral Plans

Over 50s Life Insurance or Funeral Plans?

We are always being asked what’s better, over 50s life insurance or funeral plan?

A funeral plan allows you to pay for your funeral service in advance, relieving your loved one’s of any financial stress or worry.

A life insurance plan pays out a cash lump sum when you pass away for your family to use at their own free will. When taking out an over 50s life insurance policy, you must be aged between 50 and 80 years of age. It is important to know that this type of cover has no cash value until a valid claim is made.

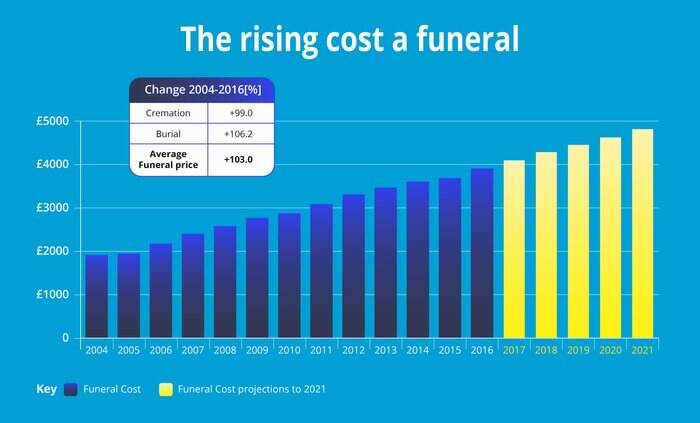

The average cost of a funeral service is constantly rising and unfortunately, there is no evidence to indicate this will stop. Upon reading the ‘Sun Life - Cost of Dying Report of 2017’ their data disclosed that the average cost of a basic funeral service had risen for the 14th year running and funeral plan prices had increased by 4.7%. Ranging from £3,897 in 2016 to £4,078 in 2017.

In 2017, Drewberry Insurance revealed that only 36.7% of working class people had a life insurance policy. In 2018 they found 46.2% of the working class population had a life insurance policy, proving more and more people are financial protecting their families.

But is a funeral plan better than an over 50’s life insurance cover?

Difference between a funeral plan and life insurance

| Funeral Plans | Over 50s Life Insurance |

|---|---|

| Pays for your funeral in advance | Provides a cash lump sum |

| Locked in at today's funeral prices | Fixed monthly payments but amount depends of personal circumstances |

| Funds only pay for your funeral | Relieves financial strain to your loved ones |

| Payment options can be spread over 5 years or paid in full | Various policies |

| Guaranteed acceptance with no credit checks | Will pay into policy until you pass away |

Over 50’s life insurance problems

In our professional opinion, we would steer clear of an over 50’s life insurance policy and opt for a funeral plan and here are a few main issues with this type of cover;

1. You may pay more in to what you get paid out - The average cost of an over 50s life cover plan with SunLife is £7.00 per month, this that pays out a lump sum of £1230.00 upon death. If you divide the payout by the monthly cost, if your still paying into this policy 14years later, you are making a considerable loss.

2. Once you have paid into your cover through your monthly payment options, this money is then non-refundable. If you miss a payment then you don not get any of your paid premiums back.

3. You are locked in at their current price plans. This means with inflation you still only get back what you agreed with from the start date of your cover.

Long-term savings

There are a variety of budget friendly plans readily available and there are also cheap plans available for even the more extravagant types of funerals.

Our funeral plans start from £1693.00 - £4,199.00 if paid via a single payment, and this is dependent on the type of plan you wish to take out. Our prepaid funeral plans start from just £17.04 per month and can be spread over 1 to 5 years.

Any payment options paid over 12 months will incur an additional charge. This charge is to further secure and protect your funeral should your chosen funeral director go into administration during your policy.

The cheapest option readily available is the one-off payment option as there are no additional charges and you are locked in at today’s prices.

Over 50s Funeral Plans

An over 50s funeral plan provides many benefits when it comes to your financial security. This plan provides a cash lump sum when you pass away by paying regular fixed payment each month just like on over 50s plan.

Benefits of an over 50s funeral plan

- You will be fully covered after 12 months. If you were to pass away shortly after the 12 months the funeral plan will be paid for.

- No credit or health checks

- If you over pay you will receive a benefit

- Ages 50 to 75 can take advantage of this plan

- Fixed low monthly payments until you are 90

- Immediate funeral cover for accidental death

With all of our over 50s funeral plans it is possible to pay more into the plan than it pays out. However, unlike over 50s life insurance you will be entitled to an overpayment rebate feature. This means if your monthly payments paid in is more than what is paid out to fund your funeral service on death; your estate will be eligible for a rebate.

Are funeral plans worth it?

In our opinion, Quote Me Less would recommend taking out a funeral plan or a prepaid funeral plan as you are fixed in at today’s prices and it takes away the financial worry and stress o others having to arrange your funeral. When purchasing a prepaid funeral plan, all moneys will be held in a trust ready for when you pass away.