Do i need life insurance?

Is a life insurance policy suitable for you?

Taking out life insurance will give you complete peace of mind in knowing that your loved ones are financially protected, should you pass away unexpectedly. Here at Quote Me Less, we are here to help you find the right life insurance cover that is tailored to your specific requirements. We use the UK’s top-leading insurance providers currently in today’s market, and all of our life insurance quotes are affordable and guaranteed to be at unbeatable prices.

Life insurance can range from as little as £5.00 - £15.00 per month.

There are many factors to take into consideration when assessing the level of cover you need such as; your current health condition, your age, whether you are a smoker or non-smoker, or whether your occupation poses health risks.

On average a smoker will pay approx. £5.00 - £10.00 more compared to a non-smoker.

To compare cheap life insurance quotes - all you need to do is click on the button below.

Here are some of the main benefits and facts to taking out either a single, or a joint life insurance policy;

There are two types of life insurance cover you can take out and these are as follows;

Level Cover - This is where the monthly amount paid into your policy, and the amount paid out to your designated beneficiary stays the same throughout the term of your life insurance policy. As your plan matures, the amount of coverage you have increases and your monthly payments will not rise with inflation. You can choose the length of your insurance cover to suit your requirements and most commonly this is between 10 and 30 years.

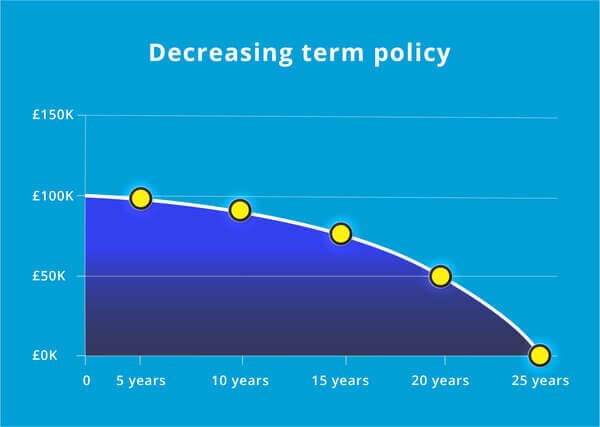

Decreasing Cover - This is where the monthly amount paid into your plan, and the amount paid out to your designated beneficiary decreases over the term of your policy. This level of cover is often used to pay off any remaining balance owed to a mortgage lender. It is more budget friendly than a level term life insurance plan as reductions in the cover are typically reviewed monthly or annually.

It is of vital importance that you read and understand all of the terms and conditions set out in your life insurance policy. Your life insurance policy will specifically detail what you are covered for and any exclusions will be stipulated in your contract.

Some of the most common exclusions set out in terms of life insurance policies, are as follows;

If at any time you are unsure or unclear about the terms set out in your life insurance contract. Please discuss these directly with your insurance broker or your intended insurance policy provider as they will able to provide you with further clarity, help and support.

We recommend that you should only take out life insurance when your family or loved ones would financially be put at risk after your passing. Taking out life insurance will give you peace of mind that your family are protected.

The amount paid to your beneficiary will depend on the level of your cover. Pay-outs can be used to pay off debts or a mortgage, to cover monthly bills and to meet heirs and descendants living needs.

If you, your partner or a family member are financially stable, you may want to consider other insurance options that are available to you which can assist you in planning your funeral. By taking out a funeral plan or a prepaid funeral plan, you can choose a payment plan that is convenient for you and for your budget.

If you think life inaurance is for you, we compare cheap life insurance quotes by using a panel of our insurance brokers.

Life insurance cover are legal contracts between an insurance policy holder and an insurer. The insurance provider pays the designated beneficiary (a person who receives the benefit of the life policy) a lump sum in exchange for a premium, upon the death of the policy holder.

All of our insurance policies are held in trust and are not part of any public records. The proceeds are paid directly to your named beneficiary upon your death, or within a specified time frame. I.e. when your child turns 18 years old or via annuities or instalments. When your life insurance is in trust, this protects the pay out from any inheritance tax.

The average monthly cost to taking out life insurance cover will depend on your personal circumstances and the type of cover you have. With a level term policy your monthly payments will always remain the same. If you choose to have a decreased term policy your payments will lower monthly or annually, depending on the term of your contract.

After you pass away, the insurer will contact your beneficiary directly to advise them of your policy and pay outs usually take between 30 to 60 days from the date of filing the claim. In the unfortunate event that the policy holder falls victim to homicide or dies within the first 2 years from the start date of their plan. Due to being within the contestability period (window in which insurance companies can deny or investigate a claim.) The person in receipt of the benefit can expect delays of payment of up to 12 months.

You may want to consider updating your life insurance cover if your financial situation changes. If your income or mortgage repayments increase, if your family grows or if your lifestyle or health situation changes. It is more beneficial to have the right cover at the best deal, tailored to your current requirements and circumstances.

Life insurance only covers you for sudden death so if you are diagnosed with a critical illness or a disability during the term of your insurance policy, you may not be covered. If you are interested in including critical illness cover within your life insurance policy, speak to our friendly and approachable team today.

Stay up-to-date with our online weekly blog on life insurance, health & wellbeing, testimonials & expert opinions and much more.

If you have any questions or concerns about taking out a life insurance plan, please take a look at our FAQ’s which may be able to help you;

Life insurance cover is a way to protect your loved ones financially when you pass away. An amount is paid out to your beneficiary after death and your family can use this lump sum of money to cover everyday expenses. These expenses can pay off your mortgage to paying off any unpaid bills.

Benefits of Life Insurance

You will need to consider the following things before you take out life insurance cover;

If you are under 50 and still healthy, life insurance is great value for money. It often works out at just a few pence per day, and with that you can ensure your loved ones are covered financially. This protects your loved ones should you pass away during the term of your life insurance plan.

It may not be easy to talk to a family member or a loved one about your death. But talking through and making these arrangements with them beforehand will give you peace of mind in knowing that they know they will be financially protected when you pass away.

Talking to them will also allow them more time to be knowledgeable about making a claim after your death. With you both being prepared for these eventualities, they will be able to ensure that they have all the relevant medical documentation, your life insurance policy documents and policy number(s) to hand.

If you decide not tell a significant other about your policy, it could go unclaimed and your beneficiary could miss out on the benefits of your life insurance cover.

You will need to calculate the level of cover you need before choosing the right plan for you as this depends on your personal circumstances. You can use the points below to help guide you;

The amount you pay in monthly premium rates depend on your age, the level of cover you require and whether your income/earnings will increase in the near future.

It is more financially beneficial to take out a life insurance when you are younger because your premiums are payable over a longer period of time. As your life expectancy is longer and you are less likely to have a serious disease or illness during the term of your cover, you are considered to be less of a risk for the insurance company.

Generally, the older you are, the higher your premium rates will be. At the end of your policy term your premiums will go up excessively as the risk of you needing to make a claim with your insurer increases dramatically. Based on current market prices, your monthly life insurance premium payments will be approximately be the following amounts;

With a level-term life insurance plan, your monthly premiums will remain the same every year. Your monthly premiums are established and set at a fixed price from the start date/ anniversary date of your plan.

With a decreasing-term life insurance plan, your premiums will be assessed and calculated annually which potentially could decrease your monthly premium payments. This is because the financial risk to the insurer decreases over time.

After you have passed away, your beneficiary will be issued with a medical certificate stating the cause of death. They will then need to register your death within 5days in the UK and 8days in Scotland, this includes weekends and national holidays.

Once your beneficiary has received your death certificate they will need to file a copy of the certificate with your life insurance company. They will then review the claim and process the pay-out within approximately 4 - 8 weeks.

In the rare instance where the policy holder dies within the contestability period (2 years, from the start date of the plan). The beneficiary can expect delays of payment of up to 12 months whilst the claim is being investigated by the insurance company.

It is vitally important that you are honest with your insurer from the outset and that you ensure you disclose all relevant personal information to them so they can make sure that you are covered correctly. If any of the information given to the insurers is knowingly incorrect or intentionally misinterpreted, the insurer could deny to pay-out the claim.

Before taking out a life insurance cover, remember to always check directly with the insurer as to what types of death you are covered for under your plan. If you die by a certain type of death which is not covered under your life insurance policy, they could refuse to pay-out a claim.

(Register a death online at www.gov.uk/register-a-death)

If you are concerned about meeting your monthly premium payments towards your life insurance, please refer to your the terms and conditions or reach out directly to your insurance plan provider. They will be able to offer you their expert advice and assistance in helping you come to an agreement with payment that suits you.

It is important to note; if you suddenly stop paying towards your term life insurance policy and do not make contact with your life insurance provider, your coverage will lapse and after your policy grace period ends, you will no longer be covered

Yes, you are able to take out life insurance for a significant other as long as you can prove that you have an ‘insurable interest’.

An ‘insurable interest’ can either be a blood relative i.e. a parent or a child, your partner by marriage or your business partner. You are able to take out life insurance for these other persons as long as you are able to evidence the following;

1) That you can take a policy

2) That the person you wish to take the plan out for;

a) consents to you taking out the policy and;

b) is willing to undergo a medical examination for the purposes of obtaining the cover

3) That you would be adversely affected financially if they were due to pass away unexpectedly

Is a life insurance policy suitable for you?

There are many reasons you may be declined a life insurance policy.

Life insurance cover is cheaper than you think.

Take a look at our tips on how to change your life insurance policy.

There are many reasons to choose a single or joint life cover

Take a look to see why funeral plans save you money in a long run.

Take a look at our tips on how to change your life insurance policy.