Do i need life insurance?

Is a life insurance policy suitable for you?

When you get older it is natural to want to leave your family and loved ones with overwhelmingly positive and nostalgic memories of all of your time spent together. If you are aged between 50 and 85 years old, taking out an over 50’s life insurance policy is a simple and affordable way to help you leave your loved ones with a lump sum of cash when you pass away. This cash sum can be used to pay towards your funeral expenses, to assist with settling any unpaid financial commitments or simply left to them as a gift.

Here at Quote Me Less, we are here to offer you a helping hand in finding the right over 50’s life insurance plan that is customised to suit your current personal circumstances. We only use the UK’s top-leading over 50’s life insurance policy providers which are currently ranking in today’s market, and all of our insurance quotes are guaranteed to be at incomparable prices.

To receive your FREE Over 50’s life insurance quote - all you need to do is click on the ‘Quote Me Now’ button below.

All over 50’s life insurance policies are single person policies and cannot be held as a joint policy. If you wish to take out a joint policy, it may be worth looking into a Joint Life Insurance Policy.

Quote Me Less recommend all customers widely research a number of different life insurance policies currently present on the market. By doing this you will be able to compare cheap over 50's life insurance policies with the aim to finding the best plan to suit your current, personal circumstances.

We also advise that you should take into consideration and assess your future financial situation as this will provide you with further assurance that you are choosing the most appropriate insurance provider for the type/ level of cover you require.

Taking out a life insurance policy would be an unnecessary expense if;

It is essential that you read and understand all of the terms and conditions set out in your over 50’s life insurance policy contract. The policy will clearly detail what you are covered for and it will also stipulate any exclusions.

The key points to note and to take into consideration when deciding whether to taking out over 50’s life insurance is as follows;

Over 50’s life insurance plans are put in place to assist your family in paying off a proportion of your funeral service and is not designed to pay for the funeral service as a whole.

If you are looking to cover the entire cost of your funeral including; the service, the burial/ cremation, covering the cost of the funeral director, hearse and coffin, it may be worth looking into a Funeral plan and Prepaid Funeral plans.

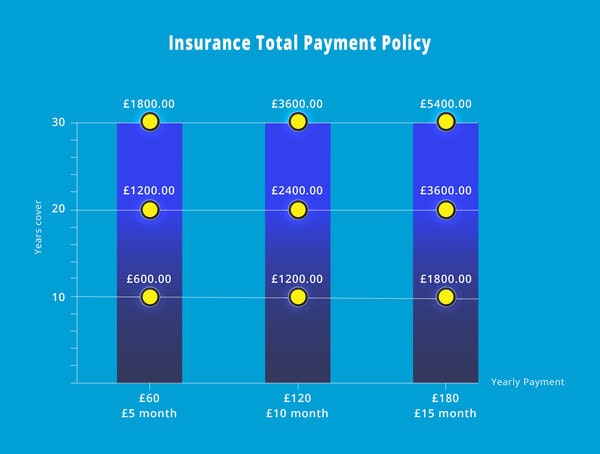

Depending on how long your policy runs for and the amount of your monthly premiums, the total paid into your cover may be greater than the cash sum paid out after your death. It is always worth checking the amount you are paying in premiums each month, multiplied by the length of your cover.

For example;

If you are 60years of age and wish to take out over 50’s life insurance cover for £1,000, with your premium payments covering the following years - you would calculate the overall payments as follows;

Monthly premium payment amount x multiplied by 12 months = Yearly payment total

Then

Yearly payment total x multiplied by number of years payments cover = Total paid into cover

| Monthly | Yearly | 10 years | 20 years |

|---|---|---|---|

| £5 | £60 | £600 | £1200 |

| £10 | £120 | £1200 | £2400 |

| £15 | £180 | £1800 | £3600 |

The total lump sum of your over 50’s life insurance cover amount will not increase in line with inflation and total paid out will remain the same amount throughout your policy.

If you take out an over 50’s life insurance policy today for £10,000 – the value of this amount will reduce after a decade or two.

According to recent financial institute studies undertaken throughout 2020, the devaluation and the current forecast levels of the British Pound will remain low throughout 2021. This has been largely affected by the current Coronavirus pandemic, increased pressure and use of public health systems and the prospect of a prolonged global recession.

With the UK economy currently suffering from recession, inflation is slow and will only gradually increase with a drop in interest rates.

Over the past few years and since the referendum, Brexit has played a key part in influencing the devaluation of the pound. In August 2020 the pound Stirling weakened in value by 1.65% against the Euro and within the same period it saw the pound weaken by 3.11% against the US Dollar. It has been speculated that the reason for the decrease in the value of the pound could have been determined by the supposed breakdown/ lack of Brexit negotiations as investors turned to trading in EUR and USD to ensure the safety of their businesses.

Over 50 life insurance pay-outs only hold value upon your death. If for any reason you stop paying your monthly premiums, your policy cover will lapse and you will not be refunded any of the previous premiums you have paid in.

If you miss a payment, your account will activate what is called a ‘30-day grace period’. This is a time frame in which you can arrange to make a payment directly with your insurance plan provider to allow the over 50’s life insurance cover to continue. If you do not make a payment within the ‘30days grace period’, the policy will be made invalid and your cover will expire.

If you are worried that you will not be able to meet your monthly premium payments or your financial circumstances change, please ensure you speak directly to your insurance plan provider as soon as possible. They will be able to offer you further guidance and assistance and may be able to offer you a ‘payment holiday’.

If you wish to use a life insurance pay out to cover significant debts i.e. to pay off your mortgage or to pay out large sums of inheritance, it may be worth looking into Life Insurance.

If you pass away in the first year of the date of your policy, the Insurance provider will only pay out the premiums paid in

If you pass away unexpectedly within the first 12months of your policy and your death was not deemed as an accident, your insurance provider will only pay out the premiums paid into the policy and not the overall lump sum your cover is for. Some insurance providers extended this period from 12 to 24months, so please ensure you are aware of which ‘deferment period’ is stipulated in your policy documents. If at any time you are unsure or unclear about any of the terms set out in your over 50’s life insurance contract, please discuss these directly with your insurance broker or your intended insurance policy provider as they will able to provide you with further clarity, help and support.

Stay up-to-date with our online weekly blog on over 50’s life insurance, health & wellbeing, testimonials & expert opinions and much more.

If you have any questions or concerns about taking out a over 50's life insurance plan, please take a look at our FAQ’s which may be able to help you;

Over 50’s life insurance policy is put in place to allow you to continue to support your family financially, when you pass away. The pay-out can be used to pay towards your funeral, to settle any of your outstanding debts, for home improvements, a holiday or even to leave a donation to one of your favourable charities.

Benefits of an Over 50’s life insurance policy

If you are looking for a life insurance policy that covers a large amount of debts i.e. to pay off the remainder of your mortgage, to pay a large sum of inheritance or you do not have any financial dependants and have enough savings to cover bills and any additional expenses when you pass away, an over 50’s life insurance plan might not be right for you.

If this is the case, click here to check out our Life Insurance Policies which may better suit your circumstances

An over 50’s life insurance policy is very similar to a ‘whole life policy’. This means the policy will last a lifetime instead of a specific number of years.

No, you will not be required at any stage to undergo a medical exam, nor will you be asked any health-related questions. No matter what your current lifestyle is or your current health condition(s), as long as you are ages between 50 – 85years old, you are guaranteed to be accepted for an over 50’s life insurance plan.

Over 50’s life insurance plan is mainly used for;

Life insurance plan

If you are wanting to leave your family or loved ones with a lump sum of money when you pass away which will be used to ensure they are financially protected, an over 50’s life insurance policy may be the right option for you.

As over 50’s life insurance is not offered based on your current health condition(s) and you are not required to undergo a physical medical examination, everyone between the age of 50 – 85years old is guaranteed to be accepted.

No, your cover amount and your monthly premium payments are at a fixed price/ rate and will not increase or rise in line with inflation.

If you are completely happy with the terms and conditions set out in your over 50’s life insurance policy, you can be covered within as little as 24hours after the date of your application.

Unfortunately, if you miss a payment you will activate a ‘30-day grace period’. This is a period in which you can arrange to make a payment to allow the cover to continue. If you do not make a payment within this time frame, the cover will lapse and your policy will be made invalid.

If you are unable to meet your monthly premium payments, please speak directly to your insurance plan provider urgently. They may be able to offer you a ‘payment holiday’ until you get back on your feet financially.

Unfortunately, if you cancel your over 50’s insurance policy after the first 30-days from the date of your insurance plan, you will not be refunded any of the premiums you have paid in to date and your cover will end.

Yes, you can take out more than one over 50’s life insurance policy but the policies combined cannot exceed premium payments of £100 per calendar month or £10,000 in overall cover

One of our helpful insurance brokers will assist you in either setting up a monthly direct debit or a standing order to enable you to meet your monthly premium payments. If you are unable to meet your monthly premium payments for whatever reason, please speak directly to your insurance plan provider as they will be able to assist you further.

To make a claim for an over 50’s life insurance policy pay-out, as the beneficiary you will need to call the insurance plan provider directly to initiate the claim. The insurance company will review the claim and will be in contact with you if they require a copy of the death certificate or any further medical information based on the circumstances of their death.

Is a life insurance policy suitable for you?

There are many reasons you may be declined a life insurance policy.

Life insurance cover is cheaper than you think.

Take a look at our tips on how to change your life insurance policy.

There are many reasons to choose a single or joint life cover

Read our top tips for when planning a funeral.