Do i need life insurance?

Is a life insurance policy suitable for you?

Everyone should consider taking out a critical illness cover, we all have those moments in life where we sit and ponder about what our future will be like. We think about past but lasting memories, getting older and wiser, and considering the prospect of possibly becoming seriously ill and not being able to physically care for or financially support our family anymore. Taking out critical illness cover, will help provide you with peace of mind in knowing that you and your loved ones will be financially protected, should you unfortunately be diagnosed with a certain illness or disability.

You should consider purchasing critical illness insurance if you become seriously ill or diagnosed with a disability with minimum savings. Critical illness cover helps relieves your family of any financial worries, if you were to be off sick for a long period of time.

Here at Quote Me Less, we compare critical illness cover quotes by using only the UK’s industry-leading insurance providers. We are here to help and guide you through every step of the process to ensure you find a policy that is affordable, reliable and is moulded to suit you and your family’s needs. Our long-term critical illness cover is there to provide you and your loved ones with a one-off, tax-free lump sum of money should you be diagnosed with a disability or a serious illness, and in the event that you should pass away prematurely as a result of this prognosis.

Compare critical illness cover quotes by clicking the button below.

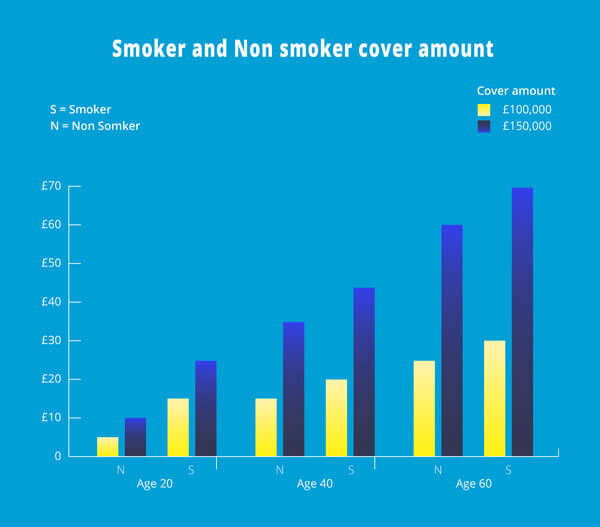

Like all insurance plans, your monthly premium payments will generally be higher if you pose a ‘risk’ to the insurers. This is because the likelihood of you needing to make an insurance claim is greatly increased.

For instance, if you are healthy and do not smoke, your monthly premium payments are going to be considerably low in comparison to someone who does smoke. As an example, if you were to take out a critical illness insurance policy with your cover paid over a period of 20years, your monthly premium payments are estimated to be as follows;

| Age | Cover | Smoker | Non smoker |

|---|---|---|---|

| 20 | £100,000 | £15 | £5 |

| £150,000 | £25 | £10 | |

| 40 | £100,000 | £35 | £15 |

| £150,000 | £45 | £20 | |

| 60 | £100,000 | £60 | £25 |

| £150,000 | £70 | £30 |

The insurance company will take into consideration the following points when assessing your monthly premium payments;

In May 2020, the Association of British Insurers (ABI) and Group Risk Development (GRiD) released new figures, which show the insurance industry paid out a record of £5.7 billion for protection claims in 2019. These figures compared with the statistics from 2018 show a total of £5.2 billion paid out in protection claims which is an increase in over £470 million a year. This is the highest percentage of claims paid on record at 98.3%.

The data from ABI and GRiD also showed that cancer was the largest, most single reason for an individual critical illness claim and the figures for the critical illness protection market was detailed as follows;

| Critical Illness insurance | |||

|---|---|---|---|

| Number of Claims paid | Percentage of new claims paid | Total Value paid | Average Value of Claims paid |

| £17,995 | 91.60% | £1,215,957 | £67,573.28 |

*Figures shown are for new claims, as well as income protection claims

(www.abi.org.uk/news/news-articles/2020/05/record-98.3-of-protection-claims-paid-out-in-2019)

It is essential that you understand all of the terms and conditions laid out in your critical illness cover documents, as not all insurance companies offer the same level of cover within their policies. It is of vital importance that you research and acknowledge the specific types of illnesses and/ or disabilities which are included within your policy. This will ensure you are taking out the right level of cover, for your individual needs.

A small percentage of critical illness insurance claims are not paid out due to the following reasons;

To ensure your claim is not rejected, please ensure you disclose any existing illnesses or current lifestyle choices to your insurance provider during the course of your application.

Any critical illness policy that is issued by the insurance provider is solely on the basis of the information given to them at the time of application. They will be unable to process a claim if you have not advised them of any potential medical risks, or you partake in dangerous activities.

Whilst all critical illness insurance plans guarantee that you will be covered for common illnesses, there are many conditions that you can be covered for within your policy. Your policy documents will include all conditions and illnesses relevant to your cover and they will detail how serious each of the conditions must be to enable you to make a valid claim.

In the unfortunate event that you become seriously ill and/ or diagnosed with a disability, most insurance companies will pay out for the following;

It’s always best to be safe when it comes to protecting your family financially. We compare critical illness cover quotes to get the best deals, all you need to do is contact us today for a free quote at no obligation.

Stay up-to-date with our online weekly blog on critical illness life insurance, health & wellbeing, testimonials & expert opinions and much more.

If you have any questions or concerns about taking out a Critical illness life insurance policy, please take a look at our FAQ’s, which may be able to help you;

Critical illness cover will help provide you and your family financial support should you be diagnosed with a serious illness or a disability. You are able to use the one-off payment to pay for treatments such as surgeries, recovery aids and everyday care. If you are unable to work due to your medical diagnosis you can also use the pay-out to help pay towards everyday expenses like utility bills, rental or mortgage payments and grocery shopping.

Benefits of Critical illness cover

You should consider taking out critical illness cover if you do not have enough savings to support your family if you were to become seriously ill or diagnosed with a disability. If you are currently in employment, it is worth checking with your employer to see if you have any current employee benefits which cover you if you are unable to work for a long period of time due to your medical diagnosis.

Critical illness cover and life insurance cover are usually classed as two individual policies. It is always worth speaking to your insurance policy provider as they may be able to add critical illness cover to your life insurance policy at no extra cost. If you find the need to make a claim on your critical illness cover and you are successful, it is reassuring to know that your life insurance policy would not be affected and they would still pay out should you pass away unexpectedly during the term of your life insurance policy.

Usually critical illness cover is a single person’s policy but some insurers can offer additional benefits to cover your family and children too. If you and your partner decide that you want to take out a joint policy, it is worth bearing in mind that the insurer will only pay out for a single claim and this is paid out to whoever is diagnosed with a critical illness first.

Taking out an insurance policy solely depends on your personal circumstances. We recommend that if you do not have a large amount of savings and have dependants who rely on your income to survive, then it is worth considering taking out a critical illness policy. With critical illness cover you can ensure that you and your family are financially protected should you become seriously ill or you are unable to work due to your medical diagnosis. Our dedicated team of life insurance brokers are here to help find you the best critical illness cover quotes from across the UK.

No, your monthly payments will not increase but like most insurance plans your premiums will generally be higher if you pose a ‘risk’ to the insurers i.e. if you are a smoker. It is always a good idea to take out an insurance policy at a young age, you will benefit from lower monthly payments as the cover is payable over a longer period of time.

Unfortunately, if you miss a monthly payment towards your critical illness cover and you do not make contact with your life insurance provider, your policy will lapse and you will no longer be covered. If you are concerned about meeting your monthly premium payments towards your critical illness policy, please refer to your policy terms and conditions or reach out to your insurance plan provider as they may be able to offer you a ‘payment holiday’

It is important to note that if you take a ‘payment holiday’ with your insurance plan provider, your future monthly premiums are likely to increase to cover the period of payments missed.

If you decide that you no longer wish to take out critical illness cover, you can cancel your critical illness policy within the 30-day cooling-off period or within 30days from the start date of your policy document, whichever is later. As critical illness cover is a type of protection insurance, if you cancel or stop paying towards your monthly payments you will no longer be covered and you will not be refunded any of the premiums you have paid.

Please check your policy terms and conditions for full details on how serious each of the conditions must be to enable you to make a valid claim.

Please ensure you read the terms and conditions for full details on how serious each of the conditions must be to enable you to make a valid claim.

Please ensure you read & check your policy terms and conditions for full details on how serious each of the conditions must be to enable you to make a valid claim.

To make a claim for a critical illness cover pay-out you will need to contact your insurance plan provider directly to initiate the claim. The insurance company will ask for the relevant medical, diagnostic and laboratory reports and will be in contact with you as soon as they have reviewed your claim.

Is a life insurance policy suitable for you?

There are many reasons you may be declined a life insurance policy.

Life insurance cover is cheaper than you think.

Take a look at our tips on how to change your life insurance policy.

There are many reasons to choose a single or joint life cover

Take a look to see why funeral plans save you money in a long run.